“Money-Related Anxiety”

Financial anxiety is a common yet deeply distressing experience that affects millions of people worldwide. The constant worry about managing expenses, paying bills, saving for the future, or dealing with unexpected financial crises can lead to overwhelming stress, sleepless nights, and even health issues. In today’s uncertain economic climate, it’s more important than ever to learn how to break free from money-related anxiety and take control of your financial life.

In this article, we’ll explore what causes financial anxiety, the emotional and psychological impact it has, and practical steps you can take to reduce your money worries. With effective strategies, mindfulness practices, and a solid financial plan, you can start managing your financial anxiety and live a more peaceful, balanced life.

Understanding Financial Anxiety

Financial anxiety is the fear or concern over one’s financial situation, often manifesting as stress, worry, or dread about money. While everyone experiences some level of concern about their finances at times, financial anxiety occurs when these worries become excessive or overwhelming.

Common Causes of Financial Anxiety

- Debt: One of the biggest contributors to financial anxiety is having large amounts of debt, such as student loans, credit card debt, or mortgages. The fear of not being able to repay loans or falling deeper into debt can be paralyzing.

- Job Insecurity: In today’s fast-paced world, job security is not guaranteed. Worries about losing a job or not having a stable income can lead to significant financial stress.

- Insufficient Savings: People often experience anxiety about not having enough savings for emergencies, retirement, or future expenses, which can create a sense of uncertainty and insecurity.

- High Living Costs: In cities with high living costs or for families with many financial responsibilities, the stress of keeping up with rent, utilities, groceries, and other essential expenses can lead to chronic worry.

- Economic Uncertainty: Unpredictable global or local economic conditions, such as inflation, recessions, or market crashes, can increase financial anxiety as people worry about their investments, savings, and the future value of money.

- Comparing Yourself to Others: In the age of social media, it’s easy to fall into the trap of comparing your financial situation to others, leading to feelings of inadequacy or failure.

Emotional and Psychological Effects of Financial Anxiety

Financial anxiety doesn’t just affect your wallet—it can also take a toll on your emotional well-being and mental health. Here are some common psychological effects:

- Chronic Stress: Constant worry about money can trigger your body’s stress response, leading to chronic stress, which negatively impacts your health.

- Feelings of Shame: Many people feel embarrassed or ashamed about their financial struggles, which can lead to low self-esteem and feelings of worthlessness.

- Decision Paralysis: When financial anxiety takes over, it can become difficult to make clear, informed decisions. This can lead to avoidance behaviors, such as not opening bills or putting off financial planning.

- Relationship Strain: Money is one of the top causes of conflict in relationships. Financial anxiety can lead to arguments with partners, family members, or friends, especially if financial priorities differ.

- Sleep Problems: The fear of financial instability can lead to sleepless nights, which, in turn, affects overall health and cognitive functioning.

How to Manage Money-Related Anxiety

Although financial anxiety can feel overwhelming, there are many practical steps you can take to reduce the stress and regain control over your finances. Below are strategies that can help you address both the practical and emotional aspects of financial anxiety.

1. Build a Realistic Budget

Creating a budget is one of the most effective ways to manage financial anxiety. It gives you a clear picture of where your money is going and helps you make informed financial decisions.

- Track Your Income and Expenses: Start by tracking all of your sources of income and your monthly expenses. Break down expenses into categories, such as housing, groceries, entertainment, and savings.

- Set Realistic Spending Limits: Once you have a clear overview, set realistic spending limits for each category. This will help you stay within your means and prevent overspending.

- Adjust as Needed: Your budget should be flexible. Life changes, such as a new job, a move, or an emergency expense, may require you to adjust your spending and saving habits. Revisit your budget regularly and make adjustments as needed.

- Use Budgeting Tools: There are many online tools and apps available to help you track your spending and build a budget, such as Mint, YNAB (You Need A Budget), or EveryDollar. These tools make budgeting easier and more organized.

2. Set Clear Financial Goals

One of the key ways to overcome financial anxiety is to set clear, actionable financial goals. Having goals provides direction and motivation, helping you stay focused and organized.

- Short-Term Goals: Start by setting short-term goals, such as building an emergency fund, paying off a credit card, or reducing unnecessary expenses.

- Long-Term Goals: Consider your long-term financial aspirations, such as saving for retirement, buying a home, or funding a child’s education. Breaking these goals into smaller milestones can make them more manageable.

- Prioritize Goals: Not all financial goals can be achieved at once, so prioritize the ones that are most urgent or important. Focus on tackling debt or building an emergency fund before investing in more ambitious long-term goals.

3. Build an Emergency Fund

An emergency fund is a safety net that can help reduce financial anxiety by giving you a cushion for unexpected expenses, such as medical emergencies, car repairs, or job loss.

- Start Small: Building an emergency fund may seem overwhelming at first, especially if you have limited income or are paying off debt. Start small by setting aside a portion of each paycheck— even $10 or $20 per week can add up over time.

- Automate Savings: Set up an automatic transfer from your checking account to your savings account each month to ensure that you consistently contribute to your emergency fund.

- Aim for 3-6 Months of Expenses: Financial experts recommend building an emergency fund that can cover 3 to 6 months of living expenses. This can give you peace of mind in case of unexpected financial hardship.

4. Address Debt Head-On

Debt is one of the leading causes of financial anxiety, and ignoring it can make the problem worse. Taking steps to address your debt head-on can help alleviate some of the stress.

- Prioritize High-Interest Debt: Start by focusing on paying off high-interest debt, such as credit cards, as this type of debt accumulates quickly. Once you’ve paid off high-interest debt, move on to other forms of debt, such as student loans or car loans.

- Use the Snowball or Avalanche Method: The Snowball Method involves paying off your smallest debts first to build momentum, while the Avalanche Method involves paying off high-interest debts first to minimize long-term costs. Choose the method that works best for you.

- Consider Debt Consolidation: If you have multiple forms of debt, consider consolidating them into a single loan with a lower interest rate. This can simplify repayment and reduce the total interest paid over time.

- Seek Professional Help: If your debt feels unmanageable, consider speaking with a financial advisor or credit counselor. They can help you create a repayment plan and offer guidance on managing debt more effectively.

5. Practice Mindfulness and Stress-Reduction Techniques

Managing the emotional aspect of financial anxiety is just as important as managing the practical side. Incorporating mindfulness and stress-reduction techniques can help you stay calm and centered, even during financially stressful times.

- Mindful Breathing: Practice deep breathing exercises to calm your nervous system. When you feel financial anxiety creeping in, pause and take a few deep breaths to ground yourself in the present moment.

- Meditation: Regular meditation practice can help reduce anxiety and improve your overall mental well-being. Apps like Calm or Headspace offer guided meditations specifically designed to reduce stress and anxiety.

- Journaling: Writing down your thoughts and feelings about money can help you identify patterns and triggers. Journaling can also help you reframe negative thoughts and develop a more positive mindset toward your financial situation.

6. Build Financial Literacy

Financial anxiety often stems from a lack of knowledge or understanding about personal finance. By improving your financial literacy, you can feel more confident and in control of your money.

- Read Books on Personal Finance: There are countless books available that provide practical advice on managing money, investing, and building wealth. Some popular titles include “The Total Money Makeover” by Dave Ramsey and “Your Money or Your Life” by Vicki Robin and Joe Dominguez.

- Take a Financial Course: Consider taking an online course on personal finance or money management. Websites like Udemy, Coursera, and Khan Academy offer a range of free and paid courses on budgeting, investing, and debt management.

- Follow Financial Experts: Follow financial experts, bloggers, or influencers on social media who share practical tips and advice. Engaging with helpful content regularly can boost your financial confidence.

7. Stop Comparing Yourself to Others

Comparison is a major source of financial anxiety. When you compare yourself to others, especially on social media, it can create feelings of inadequacy and self-doubt.

- Focus on Your Own Goals: Instead of worrying about what others have, focus on your own financial journey. Everyone’s situation is different, and success looks different for each person.

- Limit Social Media Use: If scrolling through social media makes you feel worse about your financial situation, consider limiting your time on these platforms or unfollowing accounts that trigger comparison.

8. Seek Professional Financial Guidance

If your financial anxiety persists or feels too overwhelming to handle alone, seeking professional help can make a big difference. Financial advisors and therapists can offer valuable insights and support.

- Hire a Financial Advisor: A financial advisor can help you create a comprehensive financial plan, set realistic goals, and make informed decisions. They can also help you develop strategies for managing debt, building savings, and investing.

- Consider Financial Therapy: Financial therapy combines financial planning with emotional support. If you’re struggling with the psychological aspects of financial anxiety, a financial therapist can help you explore the emotional roots of your money worries and offer practical solutions.

Conclusion

Breaking free from financial anxiety is not an overnight process, but with the right mindset and strategies, it’s entirely possible. By creating a realistic budget, setting clear goals, building an emergency fund, addressing debt, and practicing mindfulness, you can reduce your money worries and regain control of your financial future. Financial literacy and professional guidance can further empower you to manage your finances with confidence and clarity.

Remember, your financial well-being is an essential part of your overall mental health, so take proactive steps today to build a healthier relationship with money and alleviate the stress that comes with financial uncertainty.

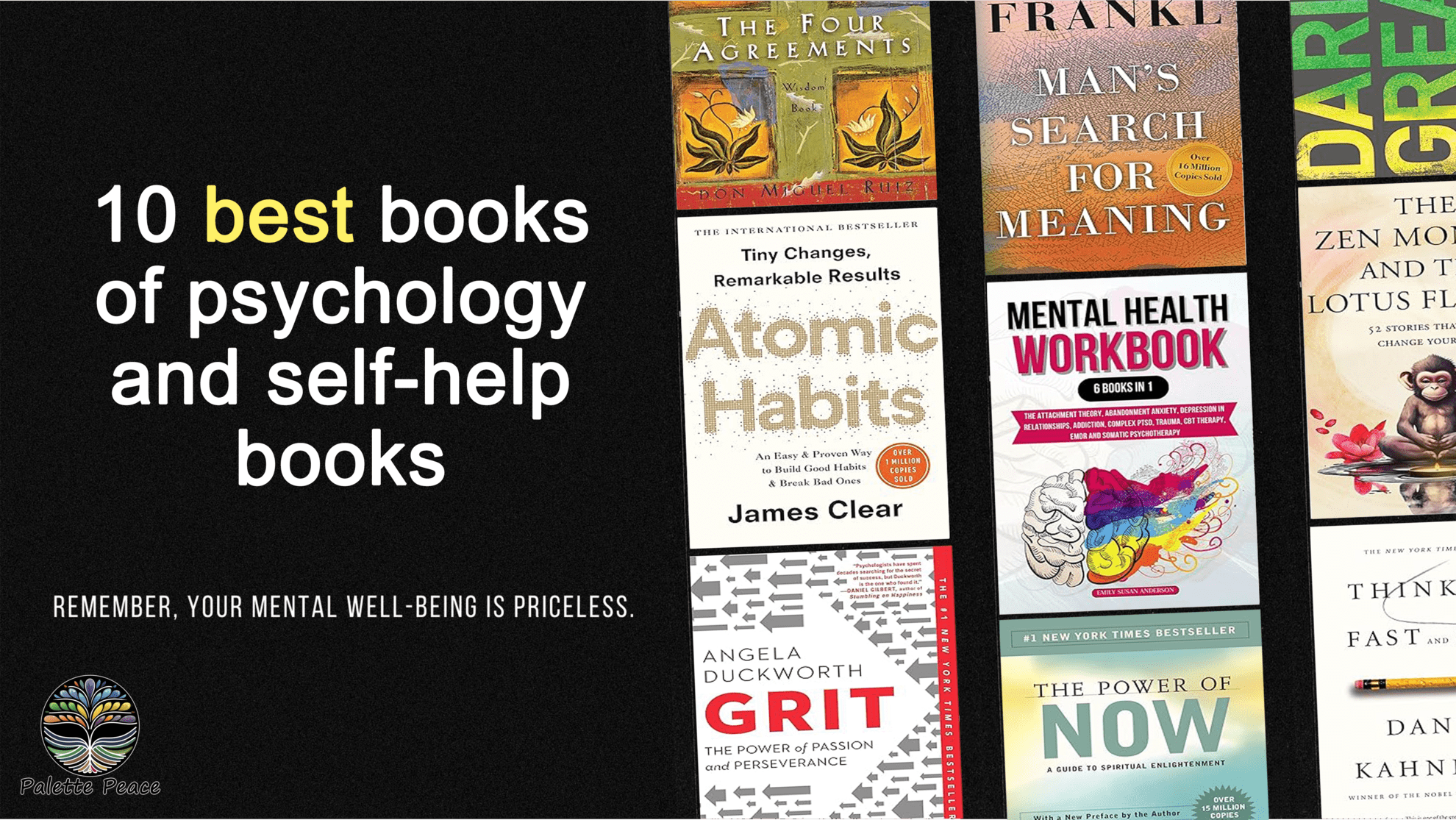

10 best books of psychology and self-help books

If you’re looking to dive into the world of psychology and self-help, these 10 books are essential reads for anyone interested in understanding the mind and improving their life. These books offer a combination of scientific insight and practical advice to help you better understand yourself and others, while also offering tools for personal growth and mental well-being.

The Therapeutic Power of Coloring: How Art Relieves Stress and Anxiety

Coloring has evolved from a childhood pastime into a therapeutic tool used by adults to combat stress and anxiety. The simplicity of this activity hides its profound benefits on mental health. From promoting mindfulness to stimulating creativity, coloring has emerged as an accessible and effective method for stress relief. In this article, we’ll explore how coloring provides a break from daily stressors, its effects on brain function, and how it can be incorporated into your routine as a method of coping with anxiety.

Let your imagination run free, Immerse yourself in a world of colors and beauty. Remember, your mental well-being is priceless.

Team coloringbookvibe.com

Coloring Book Vibe is a dedicated publisher of captivating coloring books, along with instructional books on drawing and coloring techniques. We are deeply passionate about the art of coloring, ensuring our designs are always intricate, beautiful, unique, and often infused with a touch of humor. We highly value our customers and always welcome feedback and suggestions. Our collection features an incredible array of coloring books across various genres, including Fantasy, Animals, Mandalas, Doodle Patterns, Floral, Landscapes, Country Scenes, and more.